Remember What Works

Remember What Works

Interpersonal Communications is more than just speaking with the people with whom you interact. Many pre-pandemic office practices were well established in that they integrated multiple communication processes in the existing work environments that aided employee conversation and feedback in the workplace. Procedures were in place, personnel was comfortable with them and they were easily utilized when necessary.

The Pandemic now has more management and staff working from home.

This has led to far less personal interaction and a far less structured procedure to report and have action taken on a variety of important issues, both work and personal wellbeing related.

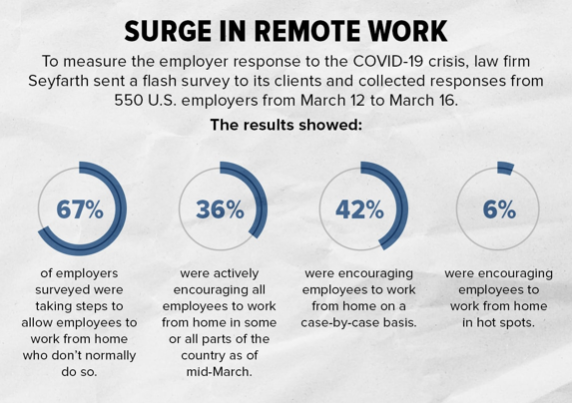

To appreciate why interpersonal communications are now more challenging than many realize, the following graphic offers an insight into the difficulties a great many companies now face.

For many, company policy & procedure manuals, and a wide range of best practices guidelines in effect prior to the pandemic were codified to the point that management, staff, and other employees knew where they could go and with whom they could speak comfortably and securely about potentially uncomfortable issues.

Then came the nationwide Covid-19 lockdown and “Working Norms” drastically changed, as shown by the adjacent survey. These reconfigurations of the “workplace” environment put a whole new complexion on these issues. When 67% of employers are actively embracing “work at home” protocols and 36% are actively encouraging employees to work from home, you know there are going to be some major changes in these companies’ corporate culture” going forward.

Here are some of the issues having to be addressed”

These major “Workplace” redefinitions and protocol changes are putting previously unseen strains on employees and adding new ones in the process.

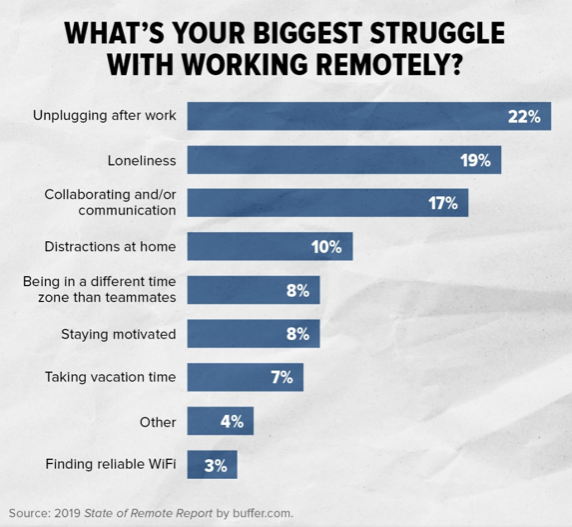

This chart shows some of the major issues found in a recently conducted survey. While all of these struggles are important, the balance between “At Home” Loneliness (19%) and “In Office” Collaborating (17%) have to be factored in with Distractions at Home (10%) to assure a continued (or perhaps even enhanced) level of productivity.

Concurrent with this is the potential need to re-define a company’s remote/flexible workplace policies, which before this event, were narrowly focused. For instance, most of these policies, in their current iteration, address short term situations such as weather emergencies or sick family members.

In the post-Covid world, companies are having to take a long-term approach and re-evaluate which previously classified “Office Only Jobs” can now be reclassified and function as “Work at Home” positions. In addition, all the elements of a company’s team-oriented culture are undergoing rapid change, and the impacts are stilled not fully known.

PRACTICAL ADVICE

Here are some steps companies and organizations may want to take as they reconfigure and codify their “Remote Workers” policies and procedures

- Establish an information command center and chief communicator. Now, more than ever, employees need information. As an employer, you need someone who’s focused on working with disbursed groups. You want to pick someone who can both talk about and helps reduce employee fears, as well as deal with their logistical concerns.

- Change your productivity mindset. While focusing on keeping everyone safe and healthy, look at maintaining or even increasing as much productivity as possible.

- Work with what you have. Organizations with a long history of teleworking spent years developing policies and procedures to meet the demands of this unique regimen. Companies, courtesy Covid-19, that must now make decisions quickly about how to handle e-mail, other remote data security, interpersonal interactions and lack thereof should “leverage the cloud,” and avoid “reinventing the wheel.”

- Be secure. It’s never too late to update virus protections and remind employees about safe remote work processes, especially if they’re using their personal laptops for official business. It’s imperative to keep an IT staffer on hand and on-call to help workers with their security and other technical issues.

- Apply policies consistently and fairly. Above all, be mindful that telework policies that have a negative or disparate impact on legally protected groups, such as women or racial minorities, can increase your exposure to a discrimination claim. Many states are asking employers to allow telework as much as possible and, in some instances, are requiring businesses to reduce capacity and the number of employees in the workplace.

It is an employer’s prerogative to decide which jobs lend themselves to remote work while others don’t, and employers making a call about who gets to work from home are running to catch up with the new reality. Data shows that some are doing a better job than others, but all will need to learn how to maneuver in this new environment. Many of the existing rules and regulations are not going to provide much help.